Most Popular Online Betting Services in Europe

Key2Casino explores preferences of European players, their interest in different types of gaming, and prognosis for the future of online betting in Europe.

As one of our previous research pieces shows, online or interactive betting is steadily growing within the gambling market. The percentage of gross win from online betting options increases every year, and tendencies show that it will only grow bigger in the future.

Taking into consideration this fact, it is worth exploring the European online gambling market, as one of the rapid growing areas to understand the preferences of players. This research is aimed to answer the following questions: Which online services bring the biggest gross win in Europe? Will those tendencies be preserved in the future? Which betting options raise the biggest interest in Scandinavia and other parts of the European continent?

The Leading Service: Sportsbook, Casino or Lotteries?

In 2018, the biggest percentage of a gross win in Europe was produced by gaming (including casino poker, bingo, and skill games). It comprised 44% of all interactive gambling on the continent, while sportsbook is not far behind (43%). At the same time, the share of lotteries was quite small – just 13%.

What is interesting, online gaming has not always been as popular as it is now. In 2003-2005 (at the very beginning of interactive gambling), European players tended to trust online sportsbooks more: with a total gross win of $3,651m for betting compared to $2,331m for gaming. One year after, casino games poker, and other gaming services overtook sportsbooks and showed rapid development due to the integration of new technologies and mobile options into this type of gambling.

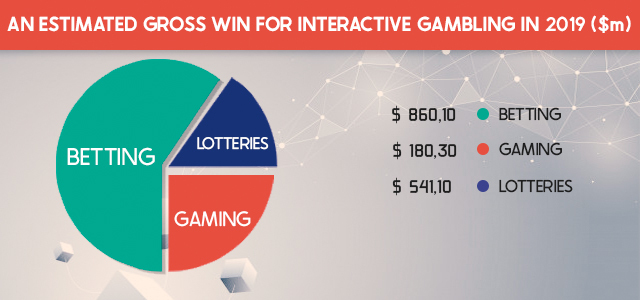

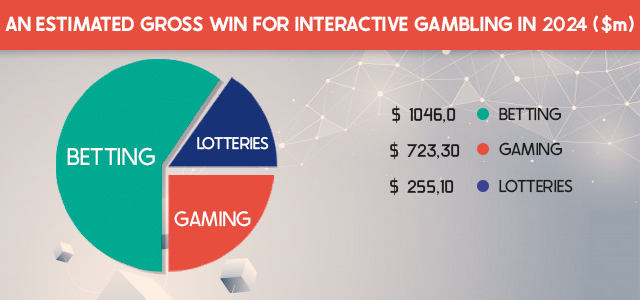

The peak of online gaming in Europe was in 2010 when it comprised 53% of the total gross win. From that time on, we see how the correlation of betting and casino games changes towards sportsbook. Furthermore, predictions of H2CG reveal that horseracing and sports are to show consistent growth, and those services might overtake the share of interactive gaming by 2024.

Scandinavia: Preferences & Tendencies

Let’s explore into detail the situation with online gambling in Nordic countries, citizens of which are engaged in this type of entertainment more than others.

The general tendency for this region is the following: steady development and an increase in the share of online casino in comparison to sportsbook. Unlike the prediction for all Europe, online gaming will continue to be the most popular betting service in the future, but sports and horseraces will be just slightly behind (43% against 40%).

Another striking difference is the solid share of lotteries if to compare it with all Europe. In 2008, each fifth player chooses online lotteries over other betting services.

If to take a closer look into Finland and Sweden separately, we will see a striking difference in preferences of players from those countries (although they are neighbors on the map).

In Finland, online gaming was not extremely popular until the beginning of the mobile era, as they mostly preferred sportsbook. However, the introduction of mobile gambling has encouraged the rapid growth of interest in casino games, so that the gross win from interactive gaming was twice bigger than that from betting services in 2011. This tendency seems to be preserved in the future, and the correlation will be the following:

- Betting – 30%.

- Casino – 44%.

- Lotteries – 26%.

At the same time, Swedish players express consistent interest in online betting services that are to bring the biggest share in the future as well.

It is difficult to give the objective percentage of each gambling service, as a regulated gambling market in Sweden has been opened only since this January. However, we can look at the prognosis of H2CG to see that sportsbook keeps leading positions in this country in the coming years.

As you could see, horseracing and sports betting will be preferred by more than half of Swedish players.

Other European Countries

On the analysis of gross win from interactive gambling in European countries, we can draw a conclusion that players in a prevailing number of them tend to choose sportsbooks when they want to try their luck and gamble online.

Only customers in Belgium, Bulgaria, Denmark, Ireland, Italy, Latvia, Slovenia, and the UK are more interested in casino games than in lotteries, sports, or horseraces. For example, in 2018, 64% of players from Ireland preferred online gaming (of which 48% - casino, 24% - poker, 28% - bingo).

Finally, let’s take a closer look at gambling preferences of UK players, as the share of interactive betting was a striking 43.1% in 2018, and it is going to grow to 56.1% by 2024. What is more, it comprises 9.5% of the total gross win in Europe. Online gaming has quickly overtaken interactive betting in this part of Europe, and this tendency will be kept in the future. In addition to that, it is easy to trace the preference of UK players, as 91% of them chooses casino games among total gaming services, and 44% among all online gambling options. At the same time, sports betting is preferred by 29% of customers in the United Kingdom, so sportsbook still has the potential for an increase in a gross win in the future.